Press Release

Norway’s salmon industry earnings hit all time high despite rising costs

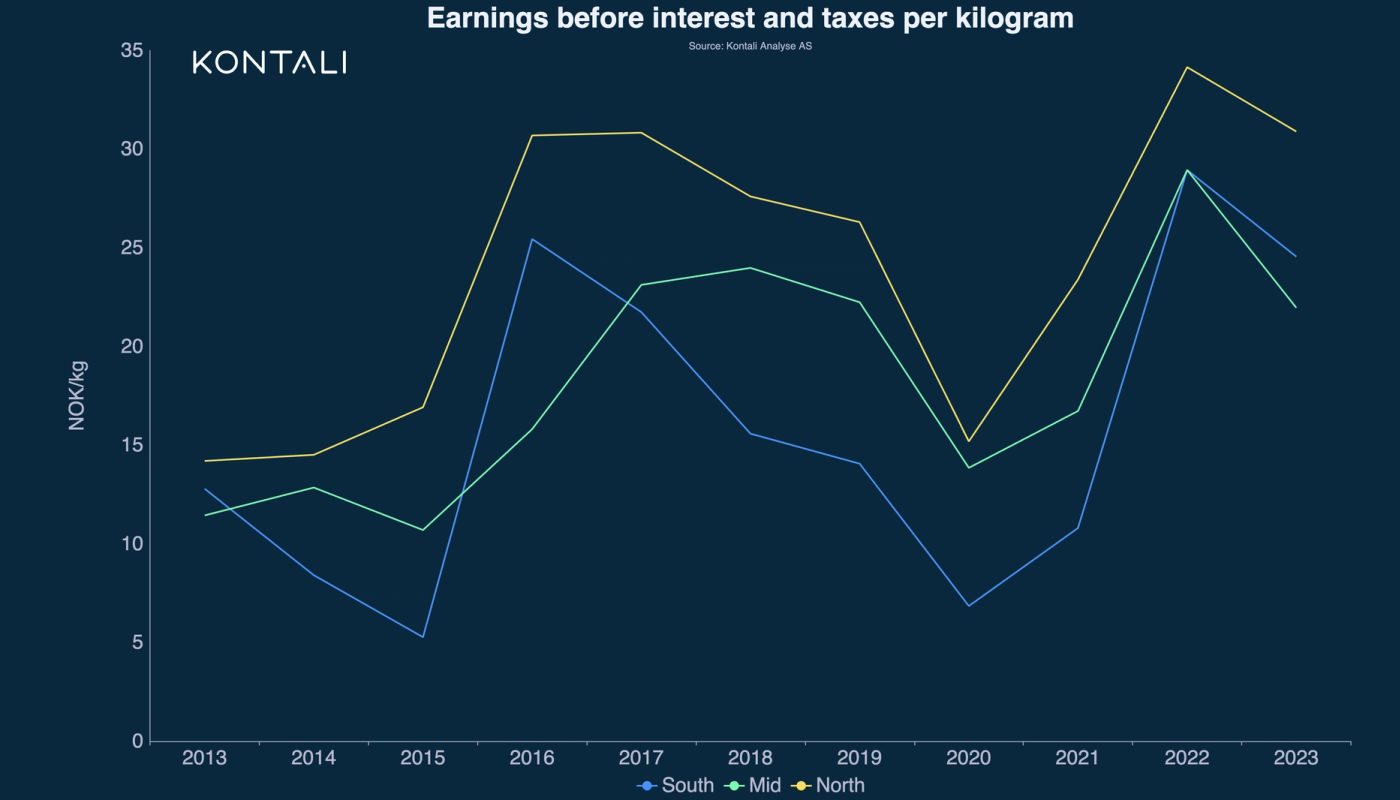

Norway’s salmon industry achieved record breaking profits in 2023, overcoming challenges such as reduced production output and rising costs. Earnings per kilogram of head-on gutted (HOG) salmon increased 15-20% to close to NOK 30 compared with the previous year, according to Kontali analysis.

The total harvest was 1.479 million tonnes (WFE) in 2023 with the value of exports hitting a record 122.4 billion Norwegian kroner (NOK) (equivalent to USD 11 billion), an increase of NOK 16.7 billion or 16%, despite lower volumes. At the macro level, the weak Norwegian kroner and the resource rent tax also impacted income.

Norway retained its position as the largest producer of salmonids, but the two percent drop in production contributed to a 1% decline in total global harvest compared to 2022. Chile, the second largest producer, harvested 1.1 million tonnes, accounting for 34% of the global market.

“2023 was an outstanding year for the Norwegian salmon industry achieving an all-time high in earnings. Prices and profits were up, though production declined marginally, down for the third consecutive year,” says Filip Szczesny, salmon analyst, Kontali. “At the regional level, North Region did excellently with the highest earnings per kilogram (EBIT/kg), reflecting exceptional profitability. Mid Region led in operational efficiency with the best capacity utilization, while South Region surpassed Mid Region in EBIT/kg for the first time since 2017,” he added.

Top performers

Among the major companies, Mowi South emerged as the leader, reporting the highest operational EBIT of 38.1 NOK/kg, a significant improvement from 24.3 NOK/kg the previous year. SalMar North followed with an EBIT of 36.7 NOK/kg, slightly below its 2022 figure of 39.8 NOK/kg.

In the mid-sized company segment, Alsaker outperformed its already strong 2022 results, recording an impressive 36.9 NOK/kg, up from 36.1 NOK/kg. Eidsfjord Sjøfarm followed closely with an EBIT of 36.4 NOK/kg, while Salaks and Kobbevik & Furuholmen tied for third place at 33.3 NOK/kg.

For smaller companies, Sjurelv Fiskeoppdrett AS stood out with an exceptional EBIT margin of 48.8%, the highest in its category. Erviks Laks og Ørret AS and Kobbvåglaks AS also delivered remarkable results, achieving EBIT margins of 46% and 45.6%, respectively, far exceeding the industry average.

Price trends and dynamics

The dip in production contributed to driving prices upward, with the weighted average price of fresh Atlantic salmon increasing by 13% to 93 NOK/kg. Price volatility was significant, with fluctuations of approximately 80% between the lowest and highest points. Segment-specific variations in price were also notable, with salmon over 7kg reaching a high of 140 NOK/kg at one point.

Price dynamics were further shaped by a fluctuating Norwegian kroner (NOK) which reached historically low levels against the Euro. While price achievements for fresh whole salmon rose by 4% in euros, the weaker NOK led to an 18% increase in NOK prices, amplifying the financial impact. European markets remain the most important for Norwegian salmon, absorbing 70% of its total exports. However, the United States and other markets had the biggest increase in export share, rising to 7% and 17.4%, respectively.

RRT estimated impact

In 2023, a resource rent tax (RRT) on salmon farming was introduced, impacting on company income across Norway. Most companies have disclosed estimated tax liabilities in the notes section of their financial accounts. Kontali’s analysis of payable RRT highlights two key findings. First, the total payable RRT is reported to be NOK 2.6-2.7 billion, which is lower than the government’s projected RRT revenue of NOK 3.5 billion. While the final tax amount is yet to be determined, any final difference could result in a significant discrepancy between the anticipated and actual outcomes of the tax’s implementation.

Second, companies harvesting 10,000 to 30,000 tonnes report the highest payable RRT per MAB unit, at NOK 5-6 per kg MAB, while larger producers harvesting over 30,000 tonnes estimate a tax cost of less than NOK 3 per kg MAB. Although the tax scheme includes a minimum standard deduction intended to provide relief to smaller players, the data suggest that mid-sized companies might be bearing the highest tax burden per MAB unit. This outcome contrasts with the government’s stated objective for the largest companies to contribute the highest share of the tax, both in absolute and relative terms.

Value chain performance

Smolt producers enjoyed a standout year, with earnings before interest and taxes (EBIT) increasing by 210%, with the average EBIT margin rising to 26%, up from 12% in 2022. Export companies also performed better than last year, achieving an 11% growth in net sales and an increase in operating margins from 1.3% to 1.7%, but the latter is still consistent with historical averages for this part of the value chain.

_______________________________

Notes to the Editor

The data and insights presented in this press release are drawn from Kontali's analysis, based on official financial statements, industry reports, and other verified sources. Key contextual points include:

Financial Data: Figures were adapted from official financial statements obtained through The Brønnøysund Register Centre, company websites, or directly reported to Kontali.

Harvest Volumes: Derived from company reports to Kontali, supplemented by financial statements and, where necessary, second-hand estimates.

Capacity Metrics: Metrics are primarily based on Maximum Allowable Biomass (MAB), reflecting changes since the introduction of capacity auctions in 2018. References to standard licences (780 tonnes or 945 tonnes in Troms and Finnmark) are included sparingly for industry familiarity.

Sample Scope:

The analysis includes 74 salmon farming companies, categorized by size: large (capacity > 25,000 tonnes MAB), mid-sized (4,500–25,000 tonnes MAB), and small (< 4,500 tonnes MAB).

Benchmarks also cover 62 smolt-producing companies (independent and integrated) and 31 exporters with distinct financial accounts.

Limitations: Financial comparisons may vary due to differences in company activities, and figures primarily reflect limited company statements, unless specified otherwise.

______________________________

Filip Szczesny

Salmon analyst

filip.szczesny@kontali.com (mailto:filip.szczesny@kontali.com)

Victor Ponsford

Press relations

victor.ponsford@kontali.com (mailto:victor.ponsford@kontali.com)

+47 94974977

About Kontali:

Kontali is a leading provider of data, analysis, and insight into the global aquaculture and fisheries sectors. With decades of experience, Kontali is dedicated to delivering high-quality information that helps stakeholders make informed decisions in a rapidly changing market.